Auto insurance is mainly designed to protect drivers in unexpected situations that involve vehicle. Purchasing the auto insurance is an overwhelming task as there are numerous insurance companies are available in the marketplace. Insured people need to compare and examine different insurance companies to choose the best one. Get into online websites and obtain free quotes from dissimilar insurance providers. It is a smart way to buy the HGV insurance at low rate. You want to provide the information related to your vehicle such as model, mileage and additional features. Insurance amounts are claimed as based on your type of vehicle and its conditions. Insurance company will ask about your preference of driving history concerning a deductible. Different kinds of factors like driving record, vehicle type and even more will only determine the actual amounts that you want to pay as insurance amounts.

Useful tips to choose the best insurance

When you are in the market for purchasing car insurance, you will be in confused state as because of numerous coverage options. First, you want to select the best insurance company. If you have past credit problems, you want to search for a company that offers second chance to obtain auto insurance discounts. Individuals who own more one vehicle can also find cheap HGV Insurance rates from a reliable provider. Further, you can transfer all your policies to one insurance company in a hassle free manner. Choose the company that rewards special discounts for drivers who have good driving record. A good insurance company offers different kinds of deductibles for the insured in an effective way. If you are injured due to negligence of another motorist, insurance company will pay your medical bills and collect it from faulty motorist later.

How to save on auto insurance?

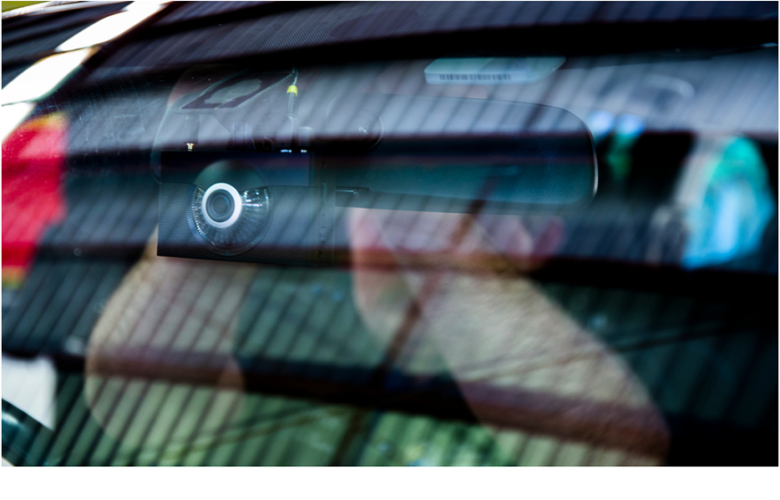

You just need to take simple and trouble-free efforts to reduce your insurance premiums. You should not purchase cars that tend to be targets for vandalism and theft. If you buy a car with a superior theft rate, you want to pay higher premiums. In that case, you can obtain useful guidelines from the insurance agents regarding the purchase of a vehicle. You want to avoid the efforts of making accidents as it reduces the premium amounts in high range. If you pay higher deductibles, you can save your money on auto insurance. Install anti-theft devices to provide great safety to your vehicles and it reduces your auto insurance premiums. Saving insurance rates are the essential part in each member part.

It will widely take every person to lead around a safer and secured path of driving. Even in the accident period, people do not have to stay in financial hectic.